Contributions

CONTRIBUTIONS

Contributions refer to a Social Security payment due for any eight hours or more of work in a contribution week . A Social Security contribution week is from Monday to Sunday.

Contributions are payable for all employees who are between ages fourteen (14) years to sixty-five (65) for each contribution week worked, for the whole or any part in which the person is employed in insurable employment.

Employers are liable to pay the total contribution due, which includes the employer’s share and the employee’s portion that is deducted from the employee’s salary. Contribution payments and the monthly Contribution Statement are both due by the 14th day of each month for the previous month worked.

Click to view: Contribution Payment Periods

Contribution Rate:

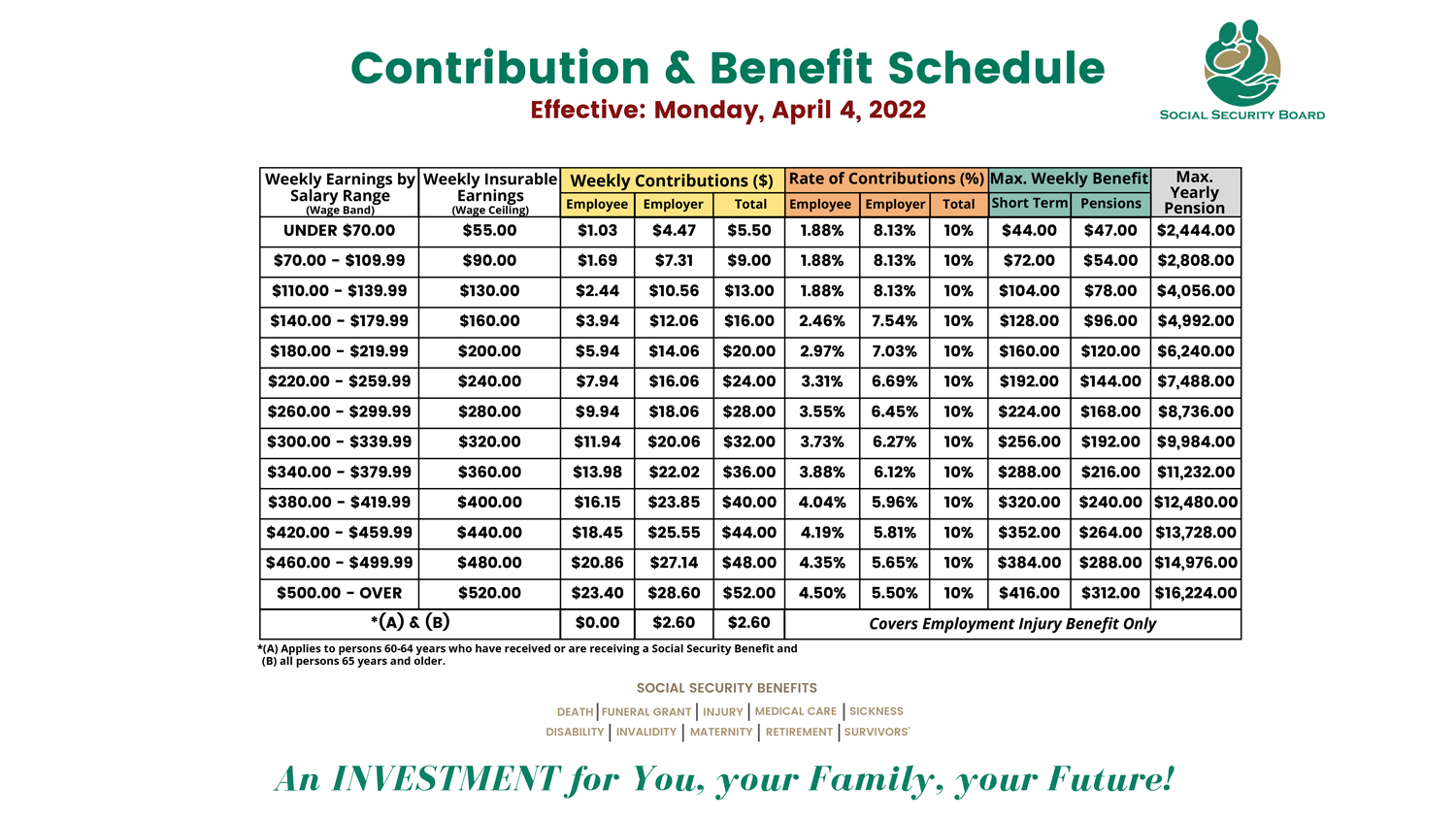

The weekly contribution deducted is related to the weekly insurable earnings, based on the employee’s actual earnings.

The First Column below shows that in the case of an employee whose weekly earnings are Under $70.00, the weekly insurable earning is $55.00. As a result, the weekly contribution payable is $1.03 for the Employee portion and $4.47 for the Employer Portion totaling $5.50.

Contribution Terms:

You may apply for a Refund of Contributions if:

- Your contributions were paid in error. The Refund Application must be made within two (2) years from the end of the Contribution Year during which the contribution was paid.

- Your contributions were paid by two or more Employers for the same Contribution Week. The Refund Application must be made within twelve (12) months from the end of the Contribution Year during which the contribution was paid.

Click here to download Refund Form (DP7).

Contributions during Period of Illness/Incapacity:

Contributions are not due, in respect of any contribution week, for the following instances:

- In which an employee does not work and receives no remuneration; or

- For each contribution week (Monday to Sunday) during which an employee is receiving a credited contribution for benefits such as Sickness, Maternity (periodical payment before and after childbirth); Employment Injury Benefit under the SSB fund. During that period, the required contribution will be paid on behalf of the insured contributor by SSB as a credited contribution.

A contribution week starts on a Monday and end on a Sunday.

The period of 52 or 53 weeks beginning with the first Monday in any calendar year and ending on the Sunday immediately before the first Monday of the succeeding calendar year.

On behalf of workers, Employers finance a portion of the contribution while the other portion is paid from the employee’s earnings.

The Employer’s share of the contribution is to be paid by the Employer. The employee’s share of the contribution is to be deducted from the employee’s earnings at the time they are paid for the period for which the contribution is payable.

Employers are required to provide their employees with monthly receipts or pay slips showing the full sums deducted from the employee’s salary for the payment of Social Security contributions.

Employers have the right to recover the employee’s share of the contribution but only by deduction from the employee’s earnings at the time they are paid for the period for which the contribution is payable. If the Employer fails to make the deduction at the time the employee’s earnings are paid, Employers then have no right to recover the employee’s share at a later date.

Under the Social Security Act, it is an offense for an Employer to recover or attempt to recover the Employer’s share of the contribution from the employee earnings.

The total amount of contribution due in respect to all employees employed during the month is to be paid to SSB no later than fourteen (14) days after the end of the month for which the contributions are due. When the 14th day falls on a weekend or on a Public & Bank Holiday, the deadline for payment is then on the first working day after the 14th. An interest on unpaid or late contributions is charged when an employer fails to pay within the prescribed time.

Complete Contribution Statements (FIN15A) enables the Board to post all contributions paid on behalf of the employees for the relevant period. Incomplete statements may cause delay in the processing of benefit claims or disallowance of benefit claims made by employees.

The Social Security number of each employee MUST be provided at all times; therefore, every employer must keep a register showing in respect of each person employed by him the following:

- The full name, address and social security number

- The dates of the commencement and termination of employment

- The date and amount of each payment of earnings; and

- The amount of weekly contribution deducted from earnings at each payment

SSB has the right to inspect employers’ records and premises to ensure that contributions are being made for all employees at the correct rate based on earnings received.

Wages paid in lieu of Notice:

If wages are paid in lieu of notice, the Employer is not liable for the payment of contribution for any week after the employment has come to an end.

Contributions during Leave (from work):

Contributions are payable for the period during which an employee is on holiday and receives remuneration, whether such remuneration is paid before, during, or after the holiday.

Under the Social Security (Collection of Contributions) Regulations, 1980, the word “Earnings” means gross earnings including:

- Overtime payments or Cost of living Bonus;

- Family allowances or payments in respect of dependents;

- Supplements or rewards for long service, industry or efficiency payments;

- Production bonus or incentive pay, service charges;

- Commission on profits or sales;

- Gratuities paid by the employer other than those paid once a year;

- Money or other remuneration paid in consideration of dirty, obnoxious or dangerous work/conditions;

- Payments in respect of shift or night work;

- Amounts deducted from earnings under any law or contract of service in respect of free meals provided by the employer;

- Any tax or other liabilities of the employed person paid by the employer on his or her behalf; and

- Holiday pay or other amounts set aside out of the employed person’s earnings throughout the year or part of the year to be paid to him/her periodically or as a lump sum.

Social Security Board insures a portion of your salary on which benefits are paid.

What are Voluntary Contributions?

Voluntary Contributions are weekly payments made by YOU (on your own behalf) as an insured contributor when you are no longer employed. A Certificate of Voluntary Insurance shall entitle the Voluntary Contributor to pay contributions in respect of any week not earlier than thirteen (13) contribution weeks prior to the date of application, and of any week for which no contribution is otherwise payable by his or on her behalf.

To qualify, you must:

- Be under 65 years of age; and

- Have not received a Retirement or Invalidity Benefit from SSB; and

- Be ordinarily resident in Belize; and

- No longer be in insurable employment; and

- Have 150 paid contributions on his behalf since June 1, 1981.

Rate of Voluntary Contributions:

The weekly contribution rate is three and one fifth percent (3.2%) of his average weekly insurable earnings on the date when he/she has ceased to be an insured person. The average weekly insurable earnings is the sum of the Insurable earnings in the best three years of contributions in the last fifteen years divided by 150. The rates may range from a minimum of $1.76 to a maximum of $10.24.

Benefits of Paying Voluntary Contributions:

It is very beneficial to an insured contributor to pay Voluntary Contributions because these payments prevent a break in your contribution payments and help you to qualify or increase your Retirement benefit or future benefits payable to your survivors.

Voluntary Contributions are Valid for:

- Retirement Benefit

- Survivors Benefit

- Funeral Grant

How and When to apply:

- A person may apply within 26 weeks after the last day of employment to the Chief Executive Officer for a Certificate of Voluntary Insurance to pay Voluntary Contributions.

- Visit the nearest SSB Branch office to request a Voluntary Insurance application form. You will informed by letter whether or not your application has been accepted along with the amount you would have to pay.

When submitting your Application for Voluntary Insurance, it is essential that you submit a list of all your past employers. Social Security will need to do a research on your contributions history to see if you meet the qualifying conditions and it will speed up the processing of your application if you submit all necessary information.

You will get a response to your application within two weeks after the office receives your request.

Payments are to be made no later than fourteen days from the date specified in the letter that you would receive from Social Security. However, if you are unable to pay on the due date, you must inform the Chief Executive Officer, who may reconsider and give you an additional four weeks in which to pay.

If your payments are more than six weeks late, you will need to reapply for Voluntary Insurance and will be required to work for an additional 50 contribution weeks in order to re-qualify.

What Happens if You Return to Work:

If you should return to work while making payments of Voluntary Contributions, you must inform Social Security immediately. You will be advised to cease payments, as your new Employer will then be responsible for payment of contributions on your behalf as an employee.

Self Employed contributions is to be paid to the Social Security Board not later than fourteen days after the end of the month for which the contributions are due. When the 14th falls on a weekend or on a public and bank holiday, the deadline for payment is on the first working day after the weekend or pubic and bank holiday.

If the employment of a self employed person ceases or interrupted because of sickness, employment injury, pregnancy, change of employment status, or other circumstances which might affect his liability to pay contributions for the whole month, he shall be liable to pay contributions up to the day immediately before the date of interruption.

A contribution of $2.60 is payable by the employer only for employees who are between the ages of 60 – 64 years old who have received or are receiving Social Security Retirement Benefit.

A contribution of $2.60 is payable by the employer for employees who are 65 years and older. There is no deduction from the earnings of workers in both of these categories.

If an employed person attains the age of sixty five on a Monday, there is no liability for payment of contribution for that week of both employer and employee share.

The Social Security contributions of $2.60 which is payable by the employer provides the employees in both of these categories with coverage for Employment Injury Benefits, which include work-related prescribed diseases in accordance with the Classification Regulations.

An employer should NOT deduct Social Security Contributions from your salary.