General Queries:

info@socialsecurity.org.bz

Short Term: Sickness Benefit

SICKNESS BENEFIT

Sickness Benefit is paid to insured members, under age 65, for a maximum of 234 days who are temporarily unable to work due to illness and who is employed when they became ill.

Quick Facts

| Eligibility | Be 14 years of age and not older than 65 years of age, and medically certified as unable to work. |

| Qualifying Conditions | Be an Insured Member in insurable employment on the day the illness/incapacity commenced, and have at least 50 paid contributions, and no less than 5 paid contribution in the 13 weeks immediately before the illness. |

| Deadline | Submit within 14 days from the 1st day of illness as shown on medical certificate. |

| Subsequent Claims | Subsequent Sickness Benefit claim(s) within 8 weeks do not require the resubmission of the Salary Record SM2. |

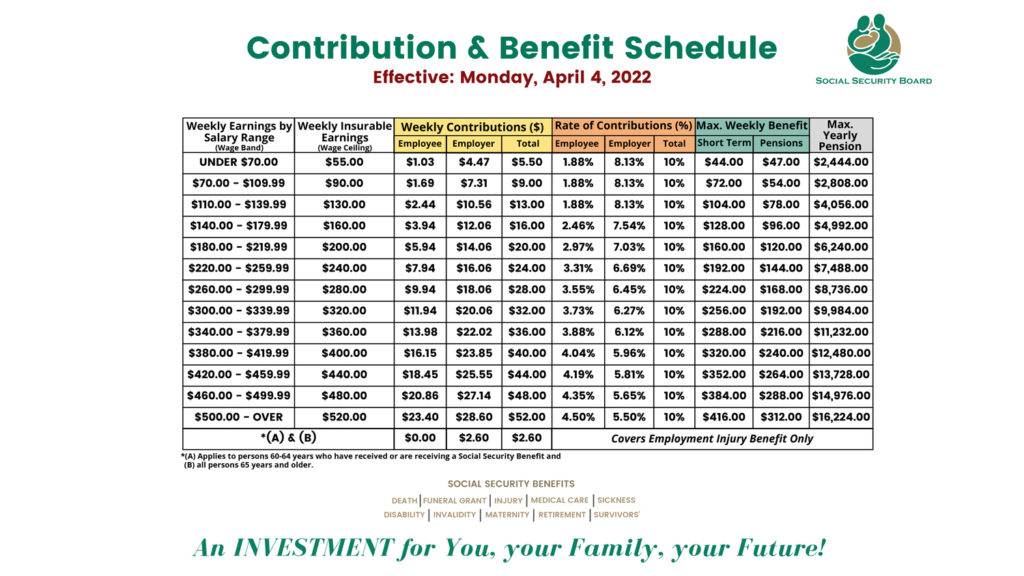

| Rate of Benefit | 80% of average weekly insurable earnings for the first 156 days, and 60% of average weekly insurable earnings for the remaining 78 days. |

| Duration of Benefit | From the first day of illness/incapacity and for a continuous period of sickness not exceeding 234 days. If unable to return to work due to the sickness being of a permanent nature, claiming for Invalidity Benefit is advised. |

How to Submit:

MY SOCIAL SECURITY:

- Complete the online form and upload all supporting documents using your My Social Security Account at SSBPORTAL.ORG.BZ

OR

IN-OFFICE:

-

- Submit your complete Claim Package at any SSB Branch Office countrywide during normal working hours.

OR

DROPBOX:

-

- Drop off all complete Claim Package into the Night DropBox located outside of the Branch Office, after working hours only.

Note: Failure to submit complete and accurate benefit claims within the 14 day deadline may result in loss of benefit/delay in payment.

Required Forms:

- Sickness Benefit SB1 Form (Front Page of SB1 Form)

- Medical Certificate also known as ‘Doctor Paper’ (Back Page of SB1 Form) AND

- Salary Record SM2/SB Form (To be filled out by HR/ Employer Representative)

Note: A friend, family member or employer may submit on your behalf in order to avoid delay.